Choosing the Best State for Your LLC. Strategic Decision. When forming your LLC, one of the most strategic decisions you will ever make is selecting the right state. Strategic decision-making affects everything from privacy to annual fees, and even your exposure to lawsuits. In this article, we’ll dive into the pros and cons of forming your LLC in Delaware, Wyoming, or Texas—the three most popular options for entrepreneurs and e-commerce businesses.

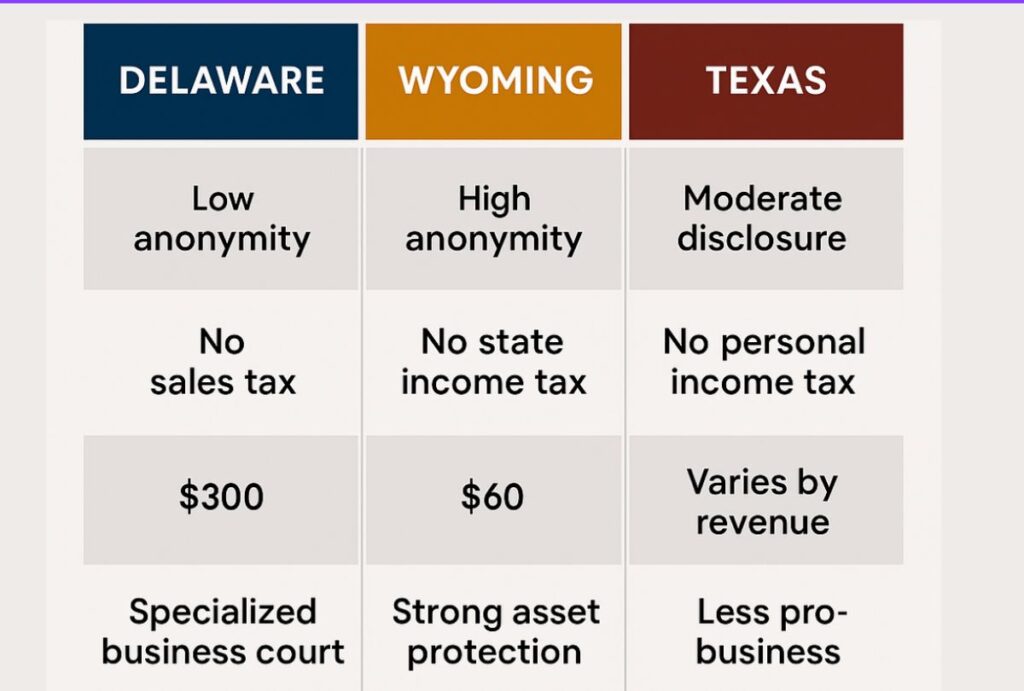

Strategic decision also means understanding how state laws impact your long-term business. Delaware is famous for its Court of Chancery and business-friendly laws. Wyoming boasts unmatched privacy and zero state income tax. Texas offers a huge market and zero personal income tax, but comes with specific legal obligations.

Delaware LLCs are preferred by large corporations and tech startups for good reason. The state offers advanced corporate legal precedents, no sales tax, and flexible rules for operating agreements. Delaware also provides anonymity for members and managers through registered agents. However, Delaware LLCs must still register as foreign entities in your home state if operating there. Learn more about Delaware’s LLC structure here: https://corp.delaware.gov/llc/

Wyoming LLCs are ideal for small businesses, asset protection seekers, and digital nomads. Wyoming does not require you to disclose member names publicly, has no state income tax, and offers incredibly low annual fees—just $60. Its asset protection laws make it a favorite for holding companies. It’s also the only state with strong protections against charging orders. For full Wyoming LLC details, visit: https://sos.wyo.gov/Business/

Texas LLCs are best suited for founders doing business within the state. Texas does not charge personal income tax, but its franchise tax applies to businesses earning over a certain threshold. Texas requires more detailed filings and has less anonymity, but offers direct access to one of the largest consumer markets in the U.S. If you’re based in Texas or plan to operate locally, this is a strong choice. Learn about Texas LLC formation here: https://www.sos.state.tx.us/corp/llc.shtml

Strategic decision becomes even more crucial when considering long-term compliance, legal exposure, and financial reporting. Choosing the wrong state can lead to unnecessary dual filings, increased fees, or poor protection in court.

In summary:

- Choose Delaware if you plan to raise capital or work with investors.

- Choose Wyoming for privacy, simplicity, and asset protection.

- Choose Texas if your market is local and you’re building a brick-and-mortar or service-based business.

Always consult with a business attorney or LLC formation service before finalizing your decision. But know that strategic decision starts with informed comparison—not guesswork.